Tesla troubles have intensified dramatically in 2025, with the company reporting its first year-on-year quarterly sales decline since 2020. Despite once being the undisputed leader in electric vehicles, Tesla delivered only 387,000 cars worldwide in the first quarter, significantly below analyst expectations of 443,000. The company’s stock has consequently plummeted more than 30% this year, making it one of the worst performers on the S&P 500.

These tesla issues extend beyond temporary setbacks, particularly as the company faces mounting tesla problems across multiple fronts. Elon Musk’s tesla troubles include fierce competition from Chinese manufacturer BYD, which reported a 13% sales gain during the same period Tesla experienced decline. Additionally, tesla car troubles related to charging times and battery range continue to push consumers toward hybrid or traditional gasoline-powered vehicles. Furthermore, tesla challenges in product innovation have become apparent, with the Cybertruck selling only 38,965 units last year—far below the predicted 250,000 by 2025. In fact, Tesla’s market capitalization has dropped 45% since hitting its peak of $1.5 trillion in December 2024, highlighting the growing disconnect between investor expectations and actual performance.

Tesla’s Recent Sales Decline: A Warning Sign

The electric vehicle pioneer’s stronghold in global markets is experiencing unprecedented challenges. Recent sales figures reveal profound tesla issues across multiple regions, signaling potential long-term tesla troubles beyond temporary setbacks.

Global market share erosion

Once dominating the EV landscape, Tesla now faces serious market share erosion worldwide. Notably, BYD is set to unseat Tesla for the first time this year with a projected 15.7% market share, ahead of Tesla’s expected 15.3%, according to Counterpoint Research. This shift became evident when BYD reported sales of more than 416,000 pure electric passenger vehicles in Q1 2025, a 39% rise from the previous year, while Tesla’s deliveries declined. In February 2025, BYD’s wholesale sales reached 318,233 units, marking a staggering 161% increase year-over-year. Meanwhile, Tesla’s European market share has plummeted to just 0.7% from 1.3% a year ago.

First quarterly decline since 2020

The company’s Q1 2025 sales plunged by 13% to 336,681 vehicles, marking its weakest performance in nearly three years. This drop was significantly worse than analyst expectations, which had projected a more modest 3.7% decline to 372,410 vehicles. Moreover, Tesla’s automotive revenue dropped 20% to $14 billion from $17.4 billion in the same period last year. This represents the most significant sales decline since the pandemic-related disruptions of 2020, underscoring the severity of current tesla challenges.

Impact on stock performance

These disappointing sales figures have severely affected Tesla’s market valuation. The company’s stock has fallen approximately 45% from its mid-December peak. After reaching an all-time high of $488.54 in December 2024, Tesla shares have experienced a dramatic decline. The market capitalization, which reached $1.5 trillion at its peak, has since plummeted to $759 billion by mid-March 2025. JPMorgan analysts noted they “struggle to think of anything analogous in the history of the automotive industry, in which a brand has lost so much value so quickly”.

Regional variations in sales drop

The sales decline shows significant regional differences, reflecting varying market conditions and consumer sentiments:

- Europe: Tesla sales fell 49% in April 2025 compared to the previous year, despite overall battery-electric car sales rising by 27.8% in the region. The company’s European sales have declined for four consecutive months.

- Germany: Sales dropped by 36.2% in May 2025, with only 1,210 cars sold. Earlier in February, the decline was even more severe at 76% compared to the same month in 2024.

- United Kingdom: Tesla experienced a 45% sales drop in May, while industry-wide EV sales jumped 28%. This pushed Tesla down to fifth place for EV sales behind Volkswagen, BMW, Audi, and Skoda.

- China: Tesla’s China-made vehicle sales in February 2025 fell 49% from the previous year, with only 30,688 units sold. January sales had already dropped 11.5% year-over-year and 32.6% from December 2024.

- United States: Sales declined by 9% year-over-year in Q1 2025, with a noticeable shift in customer loyalty patterns between “blue states” and “red states”.

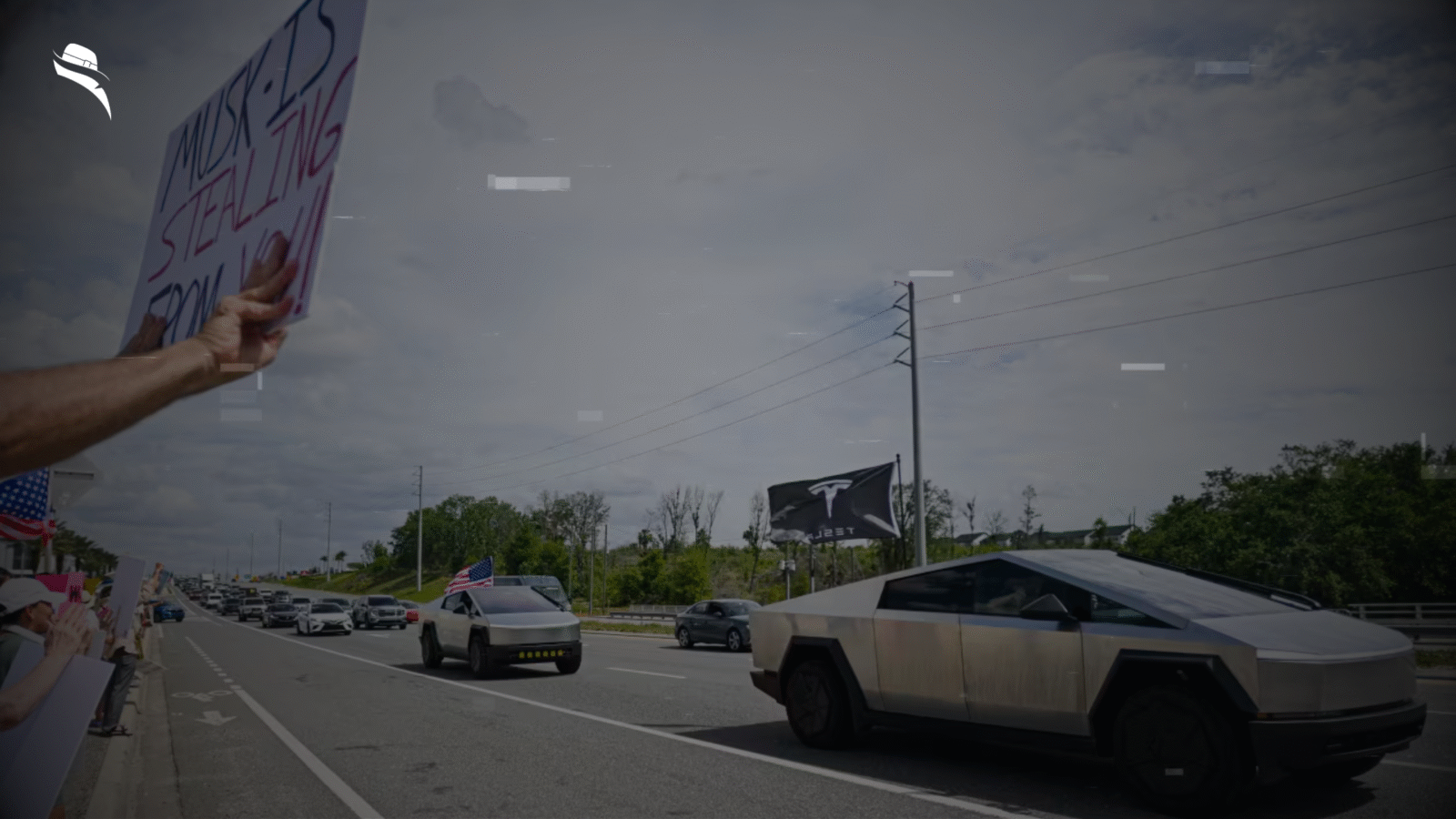

Ultimately, these declines reflect a perfect storm of tesla car troubles including aging product lines, intensifying competition, and controversies surrounding Elon Musk’s political activities. Without significant intervention, analysts from Deutsche Bank and Barclays expect this downward trend to continue throughout 2025, with projections suggesting another 5-9% sales drop for the year.

The Cybertruck Gamble: Promise vs. Reality

Elon Musk’s stainless steel behemoth stands as perhaps the most contentious gamble in the company’s history. Initially unveiled in 2019 with bold promises, the Cybertruck has become emblematic of broader tesla troubles that plague the automaker’s current situation.

Production challenges and delays

The Cybertruck faced substantial production setbacks from the beginning. Originally scheduled for production in late 2021, the vehicle endured multiple postponements before finally entering limited production at Gigafactory Texas in November 2023. These delays stemmed largely from Musk’s ambitious design choices, which proved exceedingly difficult to execute at scale. In fact, Musk himself acknowledged the severity of these tesla challenges during an earnings call, stating, “We dug our own grave with Cybertruck”. He further warned that it could take up to 18 months for the vehicle to become profitable due to scalability issues.

Price point controversies

Perhaps the most significant tesla issues surrounding the Cybertruck involve its dramatic price increases. Initially promised at $39,900 in 2019, the actual base price ballooned to approximately $70,000 by 2025 – a 75% increase. For many potential buyers, this represented an insurmountable barrier. The Foundation Series, limited to 25,000 units, launched at an even steeper $100,000+. This substantial price hike directly contradicted Tesla’s original marketing, alienating many of the reported one million reservation holders.

Market reception and unsold inventory

The market’s response to these tesla car troubles has been unmistakably negative. Although Musk projected annual sales of 250,000 Cybertrucks, the company sold just 38,965 units in 2024. By mid-2025, Tesla had accumulated over 10,000 unsold Cybertrucks worth approximately $800 million. This inventory glut forced the company to shift workers off Cybertruck production lines. First-quarter 2025 sales fell 55% from the previous quarter to just 6,406 units, allowing the Ford F-150 Lightning to overtake it as America’s top-selling electric truck.

Manufacturing complexity issues

Underlying these tesla problems are fundamental manufacturing challenges. The Cybertruck’s stainless steel exoskeleton, while visually distinctive, created unprecedented production hurdles. Tesla’s VP of Vehicle Engineering revealed that the company had to invent an entirely new manufacturing process called “air bending” to shape the steel. Additionally, Musk demanded extraordinary precision, requiring parts to be “designed and built to sub 10 micron accuracy”. This level of precision proved nearly impossible to maintain at scale, as “any dimensional variation shows up like a sore thumb” on the vehicle’s flat surfaces.

As a result, what was meant to showcase Tesla’s manufacturing prowess has instead exposed significant elon musk tesla troubles in translating ambitious vision into market reality.

Rising Competition in the EV Landscape

As Tesla grapples with mounting production issues, its once-commanding lead in the electric vehicle market faces unprecedented erosion from all sides. The company’s deteriorating position results from a perfect storm of competitive forces reshaping the industry landscape.

BYD’s rapid global expansion

Chinese automaker BYD has emerged as Tesla’s most formidable challenger, selling 322,846 vehicles worldwide in February 2025, an 8.9% increase from January. The company’s exports rose 187.8% year-over-year to 67,025 units, with 133,361 vehicles exported in the first two months of 2025—a 124% increase over the same period last year. Strikingly, BYD sold more electric vehicles in Europe than Tesla for the first time in April 2025. The company now aims to sell over 800,000 EVs overseas in 2025, double its 2024 figure.

Traditional automakers catching up

Legacy manufacturers have finally awakened to the EV transition. Ford sold 72,608 EVs in the U.S. last year, second only to Tesla, with its F-150 Lightning becoming the best-selling electric pickup. Meanwhile, Hyundai-Kia overtook both GM and Ford in 2023, capturing 8% of U.S. EV sales. Toyota plans to triple its EV production from 190,000 units in 2024 to 600,000 units in 2025, highlighting how traditional players are accelerating their electric ambitions.

Price wars in key markets

Intensifying competition has triggered brutal price battles, particularly in China. BYD recently slashed the starting price of its cheapest model to just 55,800 yuan ($7,771), introducing discounts up to 34% across 22 vehicles. This aggressive pricing has triggered a broader sell-off in auto stocks, with the Chinese government unusually intervening—the Ministry of Industry and Information Technology summoned automakers to halt the price wars.

Technology innovation from competitors

These tesla challenges extend beyond pricing. Competitors are advancing battery technology with solid-state batteries promising faster charging and longer lifespans. Lithium-iron-phosphate batteries are gaining market share due to their safety and cost-effectiveness. Simultaneously, charging infrastructure has expanded significantly—the U.S. now has 75,107 public charging stations with 207,227 ports as of January 2025, more than double the 2020 count.

Chinese manufacturers’ cost advantages

Underlying these tesla troubles is a fundamental cost disadvantage. Chinese EV makers enjoy 20-35% lower production costs than Western counterparts. This stems from lower labor rates, substantial government subsidies, and China’s leadership in battery production. Additionally, high production volumes create economies of scale that further widen this gap, allowing Chinese brands to maintain aggressive pricing while still generating profits.

Product Line Challenges and Innovation Gaps

Beyond sales figures and competition, Tesla faces fundamental challenges with its existing product portfolio. The company’s product line issues represent a critical dimension of ongoing tesla troubles that threaten its market position.

Aging Model S and Model X

The Model S and Model X, once groundbreaking vehicles, have aged considerably in the competitive EV landscape. The Model S has been on the market since 2012, while the Model X was introduced in 2015 – making them nearly a decade old with minimal updates. Subsequently, Tesla has seen sales of these premium models plummet, with just 10,695 combined Model S and X deliveries in Q1 2023. These flagship vehicles have fallen victim to what JPMorgan analysts describe as “brand staleness” – a significant tesla issue affecting consumer perception.

Delayed refreshes and new models

Tesla has repeatedly postponed critical updates to its lineup. Most recently, the company pushed back production of its more affordable EV variant (codenamed E41) by at least several months. Originally scheduled for early 2025, this crucial entry-level vehicle might not arrive until late 2025 or even 2026. Furthermore, CEO Elon Musk explicitly stated, “No Model Y ‘refresh’ is coming out this year”, despite the vehicle’s importance to Tesla’s sales volume. Although Tesla’s VP of Vehicle Engineering promised to “give some love” to the Model S and X later in 2025, these tesla car troubles have created a concerning innovation vacuum.

Battery technology stagnation

Perhaps most concerning among tesla challenges is the company’s battery innovation plateau. The highly touted 4680 cells announced during Battery Day 2021 have underperformed expectations. Rather than being better and cheaper, these cells proved “more expensive, slower charging, and had less energy density than the 2170 cells”. This technological tesla problem forced Tesla to discontinue the Model Y AWD produced at Giga Texas that used these cells. Meanwhile, Chinese manufacturers BYD and CATL have advanced their lithium-iron-phosphate technology, creating batteries “closer in energy density to Tesla’s 4680 cells” while providing “extremely fast charging rates even in cold temperatures”.

These product line challenges collectively represent a serious threat to Tesla’s recovery prospects, necessitating urgent innovation beyond Musk’s robotaxi vision.

The Robotaxi Vision: Distraction or Future Lifeline?

Amid mounting tesla troubles, Elon Musk has increasingly positioned autonomous driving technology as the company’s salvation. However, this robotaxi vision raises fundamental questions about whether it represents a lifeline or merely a distraction from core business challenges.

Repeated missed deadlines for Full Self-Driving

Musk’s self-driving promises have followed a consistent pattern of unfulfillment. In 2015, he claimed Teslas would be fully autonomous within “two to three years”. By 2018, he insisted full self-driving was “a year away,” then in 2019 declared it would be complete “by the end of the year”. During Tesla’s Q4 2024 earnings call, Musk himself acknowledged this pattern, joking that he was “the boy who cried FSD”. These tesla car troubles with timeline reliability create serious credibility issues for the company’s latest June 2025 robotaxi launch target.

Regulatory hurdles and safety concerns

Beyond technological challenges, regulatory obstacles remain formidable. Tesla lacks necessary permits to conduct fully driverless operations in California, unlike competitors Waymo and Cruise. Safety concerns persist given Tesla’s Full Self-Driving record – 1,399 crashes involving Tesla driver assistance systems have been reported to NHTSA since 2021, with 31 resulting in fatalities. The NHTSA has also specifically questioned Tesla about robotaxi performance in poor weather conditions.

Investment diversion from core business

The robotaxi focus comes at a critical juncture for Tesla’s traditional business. First-quarter deliveries fell 13% to 336,681 vehicles, marking Tesla’s largest delivery decline in history. Therefore, critics question whether robotaxi investments represent a distraction from tesla issues requiring immediate attention. Analysts from Argus and Baird downgraded Tesla stock in May, citing execution risks related to autonomy.

Market skepticism vs. analyst optimism

Wall Street remains deeply divided about Tesla’s autonomous ambitions. Bears highlight Tesla’s execution history—missed autonomy deadlines and Optimus robotics delays—as reasons for caution. Conversely, bulls argue robotaxis could unlock a trillion-dollar market opportunity, with Wedbush analyst Dan Ives predicting “a march to a $2 trillion valuation”. This stark division underscores the high-stakes nature of Tesla’s robotaxi gamble.

Technical feasibility questions

Fundamentally, tesla challenges include whether their technology approach can deliver true autonomy. Tesla relies exclusively on cameras without lidar or radar, which industry experts like Missy Cummings question, noting “If they can’t solve phantom braking for a level 2 car, they can’t solve it for level 4 or 5 vehicle”. Additionally, S&P Global Mobility identifies Tesla’s “black box” issue as a major impediment, citing lack of transparency in its AI systems.

Final Thoughts

The crossroads Tesla faces in 2025 represents more than a temporary setback—it’s a fundamental reckoning with market realities. Looking beyond individual tesla challenges, the collective weight of these issues raises profound questions about the company’s direction and Musk’s leadership approach.

What makes these tesla troubles particularly concerning is their interconnected nature. Production delays feed inventory problems, which strain finances, ultimately limiting research and development capabilities. This negative feedback loop threatens to accelerate unless decisively broken.

Nonetheless, Tesla retains significant advantages amidst these headwinds. The company’s Supercharger network remains industry-leading with over 50,000 chargers worldwide. Their energy storage business continues growing, with deployments increasing 4.1% year-over-year to 4.1 GWh in Q1 2025. Additionally, Tesla maintains approximately $27.7 billion in cash reserves, providing substantial runway to weather current storms.

In essence, Tesla’s predicament resembles Amazon’s challenging period between 2000-2002, when the e-commerce giant faced widespread skepticism after the dot-com crash. Most compelling evidence suggests turnarounds remain possible—coupled with decisive action.

Tesla’s path forward appears increasingly clear: refocus on core competencies while addressing fundamental product refreshes. This necessitates accelerating the affordable Model 2 development, streamlining Cybertruck production, and delivering meaningful updates to aging Model 3 and Y vehicles.

Under those circumstances, Musk’s attention division between Tesla and his other ventures (X, SpaceX, xAI, Boring Company, and Neuralink) becomes increasingly problematic. The CEO spent just 51% of his working hours on Tesla in 2024, according to internal time tracking—henceforth raising legitimate concerns about leadership focus during this critical juncture.

With this in mind, Tesla’s 2025 troubles represent both existential threat and potential renewal catalyst. The company that revolutionized electric mobility now confronts its most significant test—whether it can revolutionize itself.

Explore more in our Technocrats category for in-depth analysis and the latest updates.

Q1. What are the main challenges Tesla is facing in 2025? Tesla is grappling with declining sales, increased competition from companies like BYD, production issues with the Cybertruck, and an aging product line. The company reported its first year-on-year quarterly sales decline since 2020, with global market share erosion and stock performance taking a hit.

Q2. How has the Cybertruck launch impacted Tesla? The Cybertruck launch has been problematic for Tesla. Production delays, price point controversies, and manufacturing complexity issues have led to lower-than-expected sales and a buildup of unsold inventory. These challenges have exposed significant difficulties in translating Tesla’s ambitious vision into market reality.

Q3. Who are Tesla’s main competitors in the EV market? Tesla’s main competitors include Chinese automaker BYD, which has shown rapid global expansion, as well as traditional automakers like Ford, Hyundai-Kia, and Toyota, who are catching up in the EV market. These competitors are leveraging cost advantages, technological innovations, and aggressive pricing strategies to challenge Tesla’s market position.

Q4. What issues does Tesla face with its current product line? Tesla’s product line faces challenges with aging models, particularly the Model S and Model X. The company has delayed critical updates and new model releases, including a more affordable EV variant. Additionally, there are concerns about stagnation in battery technology innovation, with the highly anticipated 4680 cells underperforming expectations.

Q5. How is Elon Musk’s focus on robotaxis affecting Tesla? Elon Musk’s emphasis on autonomous driving technology and robotaxis has raised questions about whether it’s a distraction from Tesla’s core business challenges. While Musk sees it as a potential lifeline, the company has repeatedly missed deadlines for Full Self-Driving capabilities, and there are significant regulatory hurdles and safety concerns to overcome. This focus comes at a time when Tesla needs to address immediate issues with its traditional vehicle business.

Leave a Reply