The Strait of Hormuz importance cannot be overstated, as this narrow waterway handles nearly 20% of global oil consumption and approximately one-third of the world’s liquefied natural gas trade. When we examine these figures closely, the strategic significance becomes clear – in 2018 alone, 21 million barrels of oil worth $1.17 billion daily passed through this crucial chokepoint.

Located between the Omani Musandam Peninsula and Iran, the Strait of Hormuz is surprisingly narrow, measuring just 30 miles at its tightest point. Despite its small size, this passage serves as the primary route for oil shipments from Saudi Arabia, Kuwait, Iraq, Iran, and the United Arab Emirates, collectively representing approximately 30% of the world’s traded oil. Additionally, one-fifth of all global oil movements and one-third of the world’s liquified petroleum gas shipments travel through this strategic corridor. Consequently, any disruption to this vital maritime passage would likely trigger massive spikes in oil prices, affecting consumers worldwide.

In this article, we will explore the current crisis unfolding in the Strait of Hormuz, examine its profound importance to global energy security, and analyze how regional tensions could impact international markets and geopolitical stability.

Iran threatens to close the Strait of Hormuz amid rising tensions

Tensions escalated dramatically as Iran’s Parliament voted to close the Strait of Hormuz following direct military action by the United States against Iranian nuclear facilities. This move represents one of the most serious threats to global oil security in recent years, with profound implications for international energy markets.

What triggered the 2025 closure vote?

The parliamentary vote came in immediate response to “Operation Midnight Hammer,” a series of U.S. airstrikes targeting three key Iranian nuclear sites at Isfahan, Fordow, and Natanz. The attack, which President Donald Trump called a “spectacular military success,” reportedly involved six bunker buster bombs dropped on Fordow and more than two dozen Tomahawk missiles launched at the other two facilities. This marked the first direct American military involvement in the escalating conflict between Iran and Israel.

Iranian Foreign Minister Abbas Araghchi stated that the U.S. had “decided to blow up diplomacy” and warned of “everlasting consequences”. Furthermore, Hossein Shariatmadari, the Iranian Supreme Leader’s representative, called for immediate retaliation, specifically mentioning closing the Strait of Hormuz to American, British, German, and French ships.

How Iran’s Supreme National Security Council fits in

Although the Iranian Parliament endorsed the measure to close this critical chokepoint, the final decision rests with Iran’s Supreme National Security Council and Supreme Leader Ayatollah Ali Khamenei. According to Iran’s state-run Press TV, the Supreme Council must make its decision by Sunday night.

Revolutionary Guards Commander Esmail Kosari clarified the process: “The Parliament has reached the conclusion that the Strait of Hormuz should be closed, but the final decision in this regard lies with the Supreme National Security Council”. He added that such action “will be done whenever necessary”.

Iran has historically used threats to close the Strait as leverage against Western pressure. However, U.S. Secretary of State Marco Rubio called any attempt to block the strait “economic suicide” for Iran, noting that such action “would merit a response, not just by us, but from others”. Indeed, Rubio suggested China should persuade Iran to keep the shipping lane open, given Asia’s dependence on oil delivered through this route.

Strait of Hormuz handles 20% of global oil trade

Global oil markets fundamentally rely on the critical waterway that connects Persian Gulf producers with international consumers. Currently, flows through the Strait of Hormuz represent more than one-quarter of total global seaborne oil trade.

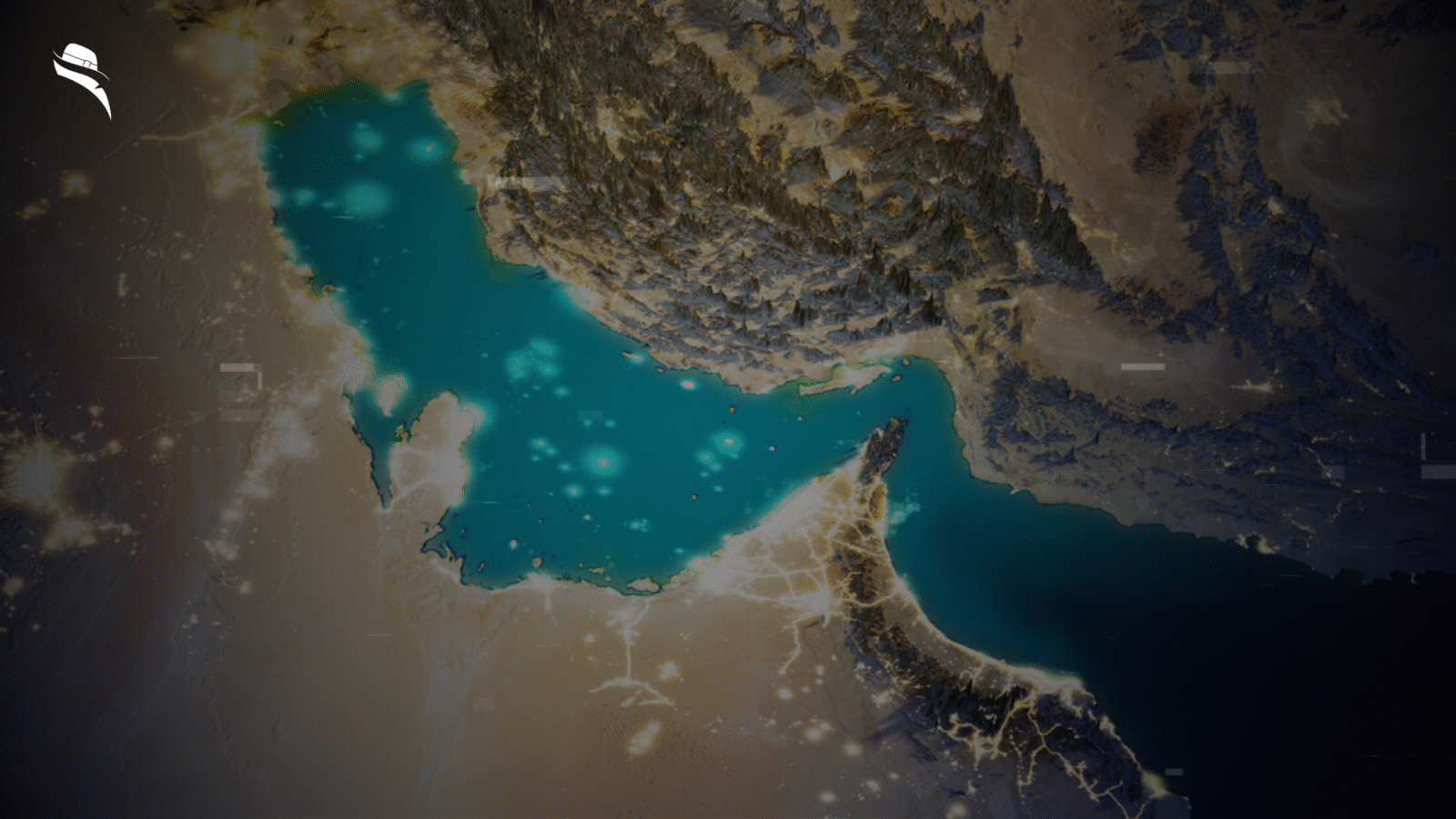

Where is the Strait of Hormuz located?

The Strait of Hormuz runs between Oman and Iran, connecting the Persian Gulf with the Gulf of Oman and the Arabian Sea. At its narrowest point, this crucial passage spans merely 21 miles. The navigable section consists of two 2-mile-wide channels for inbound and outbound shipping with a 2-mile buffer zone between them. The strait is sufficiently deep and wide to accommodate the world’s largest crude oil tankers, making it an ideal transit route for massive oil shipments.

Strait of Hormuz importance to energy security

The strategic significance of this chokepoint cannot be overstated. Oil flow through the strait averaged 20 million barrels per day (b/d) in 2024, equivalent to about 20% of global petroleum liquids consumption. Moreover, approximately one-fifth of global liquefied natural gas trade also transits through this passage, primarily from Qatar.

Most volumes that pass through have no alternative means of exiting the region. While Saudi Arabia operates the 5-million-b/d East-West crude oil pipeline and the UAE maintains a 1.5-million-b/d pipeline to Fujairah, these alternatives provide limited capacity compared to the strait’s volume.

Strait of Hormuz economic importance

The economic implications of any disruption to this waterway would be profound. As a chokepoint, even a temporary inability of oil to transit would create substantial supply delays, raise shipping costs, and potentially increase world energy prices.

China, India, Japan, and South Korea are particularly vulnerable as the top destinations for crude oil moving through the Strait of Hormuz, accounting for 69% of all crude oil and condensate flows in 2024. Exports from Saudi Arabia alone represented 38% of total Hormuz crude flows (5.5 million b/d).

While the United States has reduced its dependence, with imports through the strait accounting for only 7% of its total oil imports, any blockage would trigger global market disruptions, affecting consumers worldwide through higher prices and potential supply shortages.

Iran’s military history in the Strait raises global alarm

Iran’s historical actions in the Strait of Hormuz have established a pattern of maritime aggression that raises significant concerns for global security. This vital waterway has repeatedly become a flashpoint for military confrontations, with Iran using it as a strategic pressure point against Western interests.

Key incidents: Tanker War, Operation Praying Mantis, 2019 tanker attacks

Historically, the 1980s Tanker War marked Iran’s first major effort to disrupt shipping in the Strait. During this period, Iran attacked nearly 200 vessels from various nations using mines, missiles, and small boat harassment tactics. In response, the United States launched Operation Praying Mantis in 1988, which destroyed several Iranian naval vessels and oil platforms after an American ship struck an Iranian mine.

More recently, the 2019 tanker attacks demonstrated Iran’s continuing willingness to threaten maritime security. In May and June 2019, six oil tankers were damaged in the Gulf of Oman near the strait, with the United States and allies attributing the attacks to Iran’s Revolutionary Guards. These incidents prompted increased naval patrols and heightened regional tensions.

How Iran uses the IRGC Navy to assert control

The Islamic Revolutionary Guard Corps Navy functions separately from Iran’s regular navy, primarily focusing on asymmetric warfare tactics in the confined waters of the strait. Unlike conventional naval forces, the IRGC Navy employs swarms of small, fast attack boats, mobile coastal missile batteries, and sea mines to threaten larger vessels.

This unconventional approach enables Iran to maintain plausible deniability while creating maximum disruption with minimal resources. The IRGC regularly conducts exercises demonstrating its ability to deploy these assets throughout the strait rapidly.

What past threats reveal about Iran’s strategy

Iran’s recurrent threats regarding the Strait of Hormuz reveal a calculated strategy of brinkmanship rather than suicidal intentions. By periodically threatening to close the strait, Iran seeks leverage in international negotiations and demonstrates its capability to disrupt global energy markets if provoked.

Nevertheless, Iran recognizes that actually closing the strait would likely trigger an overwhelming military response from the United States and its allies. Hence, Iran typically employs limited provocations that stay below the threshold of triggering full-scale conflict.

Global powers prepare for potential disruption

Major world powers are rapidly mobilizing resources as Iran’s threat to close the Strait of Hormuz grows more credible. With U.S. strikes against Iranian nuclear facilities triggering parliamentary votes to obstruct this vital shipping lane, global stakeholders are implementing contingency plans.

How the U.S. and allies are responding

The United States has dispersed its naval assets throughout the Persian Gulf region to prevent concentrated vulnerability. This strategic repositioning includes the Fifth Fleet stationed in Bahrain, which stands ready to counter any Iranian attempt to obstruct the waterway. Simultaneously, U.S. Secretary of State Marco Rubio has warned that closing the strait would be “economic suicide” for Iran and “merit a response, not just by us, but from others”.

Beyond military preparations, diplomatic efforts have intensified. Notably, the U.S. has urged China to exercise its influence over Tehran, with Rubio stating, “I encourage the Chinese government in Beijing to call them about that, because they heavily depend on the Straits of Hormuz for their oil”.

What alternative oil routes are available?

Currently, several bypass options exist, yet all fall dramatically short of replacing the strait’s capacity:

- Saudi Arabia’s East-West Pipeline (Petroline) – 5 million barrels per day capacity

- UAE’s Abu Dhabi to Fujairah pipeline – 1.8 million barrels per day

- Iran’s Goreh-Jask Pipeline – Limited 300,000 barrels per day

Together, these alternatives provide approximately 2.6 million barrels per day of available capacity—barely 13% of the strait’s current flow. Additionally, these pipelines typically operate below maximum capacity, requiring time and infrastructure upgrades for full utilization.

How China and India could be impacted

Asian economies would bear the brunt of any disruption. The Energy Information Administration reports that 84% of crude oil and 83% of liquefied natural gas transiting through Hormuz went to Asian markets in 2024. China, India, Japan, and South Korea collectively received 69% of all Hormuz crude flows.

For India, roughly 2 million barrels per day—a significant portion of its 5.5 million daily imports—pass through the strait. Nevertheless, India has diversified its supply sources, increasingly relying on Russian oil that uses alternative routes. Correspondingly, China faces greater exposure, with 47% of its seaborne crude coming from Iran alone.

Final Thoughts

Despite Iran’s parliamentary vote to close the Strait of Hormuz, historical precedent suggests a full blockade remains unlikely. In fact, Iran has never completely blocked the Strait during any previous conflict. The most serious threat occurred during the Iran-Iraq War’s “Tanker War” of the 1980s, yet even then, the waterway remained operational under military escort.

The economic self-interest factor cannot be overlooked. Any closure would directly impact Iran’s own oil exports through Kharg Island, which handles 96% of its shipments. Such action would essentially constitute “economic suicide,” as described by U.S. officials.

Prior threats in 2011-2012 and 2019 demonstrated Iran’s strategic approach—using the possibility of closure to create market uncertainty without crossing red lines that would trigger an overwhelming military response. This pattern of brinkmanship without follow-through reflects calculated risk assessment rather than suicidal intent.

Current oil market conditions provide important context. Global oil prices have already increased by 10% since recent hostilities began, with Brent crude reaching $77 per barrel. Should tensions escalate further, analysts at Goldman Sachs project prices could exceed $90 per barrel, while Citigroup forecasts similar figures specifically tied to Strait disruption.

Interestingly, Iranian state media has promoted extreme scenarios claiming oil could reach $400 per barrel—figures that experts consider hyperbolic. Yet, regardless of exact numbers, any significant disruption would create substantial price shocks.

The Pentagon’s authorization for “voluntary departure of military dependents” from the Middle East and the UK maritime agency’s warnings about “increased tensions” affecting shipping illustrate the seriousness with which global powers view the situation. Nonetheless, oil markets remain adequately supplied due to OPEC’s 4 million barrels per day spare capacity and pre-conflict global surplus.

Ultimately, the greatest deterrent to Iran closing the Strait remains China, its primary oil customer. Any blockade would severely impact Chinese energy security, as China sources 47% of its maritime crude imports from the Middle East Gulf region.

2 Comments